Your browser is not supported by our website. Some features of the site are not available or will not work correctly. See the procedure to update your browser

Passive strategies starting at 0.05%

New Desjardins Index ETFs

With our range of Desjardins Index ETFs, you'll have access to a selection of asset classes for their geographic exposure, diversification and competitive management fees. You don't need to go elsewhere to build your portfolios easily: Desjardins is the partner of choice!

The annual management fees are affordable, which means lower fees for your clients' portfolios.

The broad selection of Desjardins Index ETFs makes it easier to gain geographic exposure and diversify in-demand asset classes.

Desjardins Index ETFs seek to replicate the return of the markets in which they invest.

Building cost- and yield-efficient portfolios is made easy by finding passive Desjardins ETFs (low cost) and active Desjardins ETFs (alpha) from the same solutions provider.

| Desjardins Index ETFs | Management Fees | |

|---|---|---|

| DCU | Desjardins Canadian Universe Bond Index ETF | 0.07% |

| DCS | Desjardins Canadian Short Term Bond Index ETF | 0.07% |

| DCG | Desjardins 1-5 Year Laddered Canadian Government Bond Index ETF | 0.12% |

| DCC | Desjardins 1-5 Year Laddered Canadian Corporate Bond Index ETF | 0.15% |

| DCP | Desjardins Canadian Preferred Share Index ETF | 0.40% |

| DCBC | Desjardins Canadian Corporate Bond Index ETF | 0.15% |

| DMEC | Desjardins Canadian Equity Index ETF | 0.05% |

| DMEU | Desjardins American Equity Index ETF | 0.05% |

| DMEI | Desjardins International Equity Index ETF | 0.20% |

| DMEE | Desjardins Emerging Markets Equity Index ETF New | 0.25% |

| DMID | Desjardins American Mid Cap Equity Index ETF New | 0.10% |

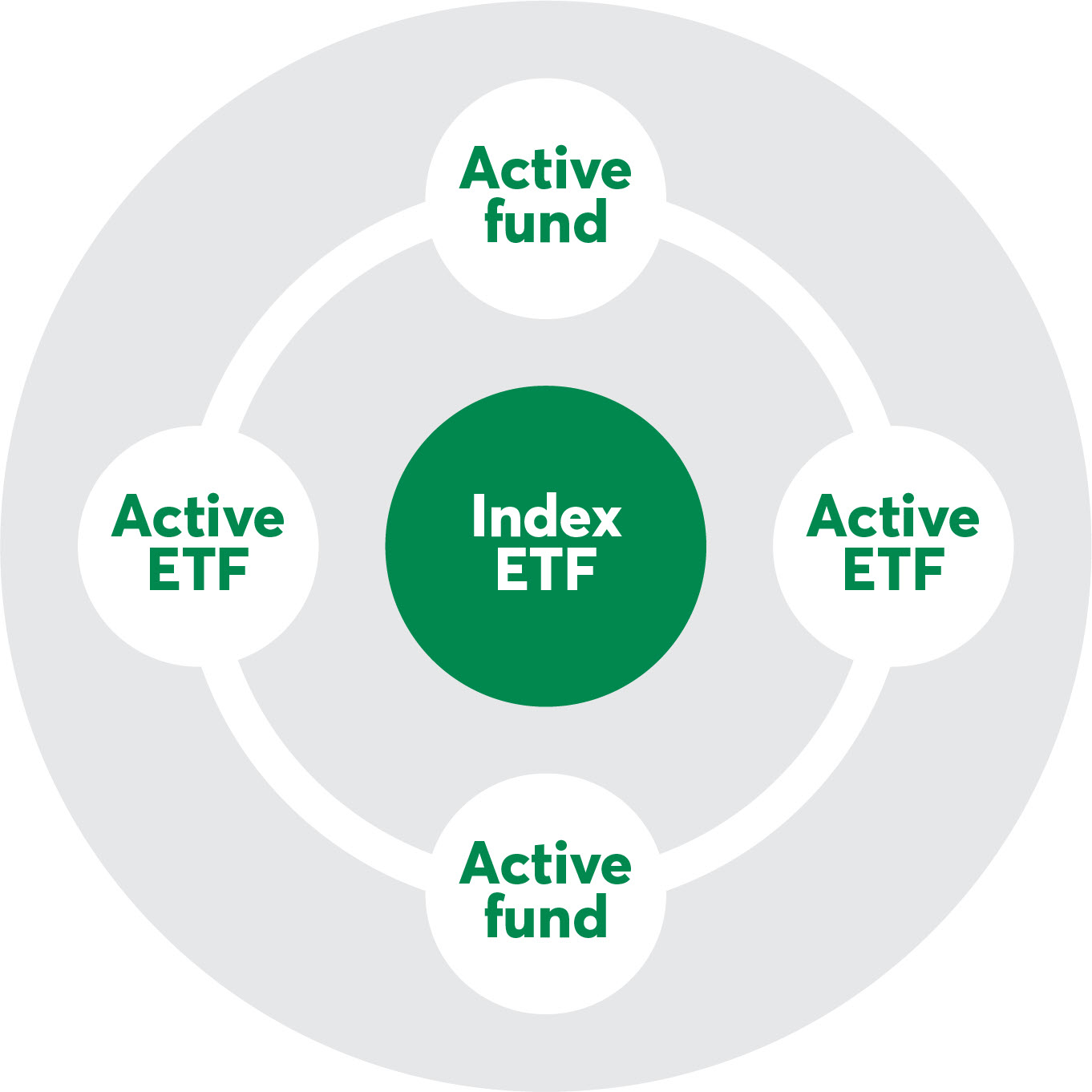

Applying a core-satellite strategy can promote a balance between return and active risk and help achieve attractive long-term returns.

In some cases, active management performs better than passive management because there will always be active managers capable of outperforming the market. By combining active and passive approaches, your clients are more likely to take advantage of tactical allocations while reducing their fees. So why not let your clients benefit?

"Core" Index ETFs

Active “satellite” funds or ETFs

| Our team | ||

|---|---|---|

|

Desjardins Global Asset Management Inc. (DGAM) is one of the largest portfolio managers in Canada. |

||

|

$118.76 B+

in assets under management |

100

investment professionals |

20+

ETFs |

Contact your sales manager.

Desjardins Index ETF Leaflet - This link will open a new window.

Investment Executive: «Why are passive ETFs a low-cost solution for investors?» (WEB) - This link will open a new window. May 27, 2024. [cited May 28, 2024].

The ETF's annual management fee based on the ETF's value on May 30, 2024.

As at December 31, 2024.

Desjardins Exchange Traded Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. Commissions, management fees and expenses may all be associated with an investment in exchange traded funds. Please read the prospectus before investing. Desjardins Global Asset Management Inc. is the manager and portfolio manager of Desjardins Exchange Traded Funds. Funds are offered by registered brokers.

Desjardins ®, the trademarks containing the word Desjardins and their logos are trademarks of the Fédération des caisses Desjardins du Québec, used under licence.

The core-satellite approach recognizes the fundamental differences between passive and active management to leverage the best of both management approaches. Passive management uses index ETFs to create the “core” of the portfolio, which provides diversification at a low cost. With active management, we add “satellite” investments that are actively managed and have the potential to outperform the indexes over time to the heart of the portfolio. https://www.fondsdesjardins.com/information/Wise_etf_client_brochure.pdf